EastBridge Investment Group (OTCBB: EBIG), a provider of financial services to emerging companies primarily located in Asia, with clients similar to companies like Chinacast Education Corporation (Nasdaq: CAST) and China Edu Corporation (Nasdaq: CEDU), could benefit from the 30x earnings multiples seen in China’s growing education sector, with its clients Tsingda Education and Wonder Education.

EastBridge Investment Group (OTCBB: EBIG), a provider of financial services to emerging companies primarily located in Asia, has a unique business model that involves taking 10% to 20% equity stakes in clients that it helps obtain a listing on U.S. stock exchanges. With two of its upcoming clients operating in China’s education industry, the company appears well-positioned to benefit from high multiples.

A Look at China’s Education Industry

With the fastest growing economies in the world, China’s education industry is booming with children and adults seeking the knowledge to stay ahead of the curve. The JLJ Group estimates that the industry reached $200 billion in size last year with more than 100,000 registered training companies. However, the market remains underdeveloped in many cities and there are few clear market leaders.

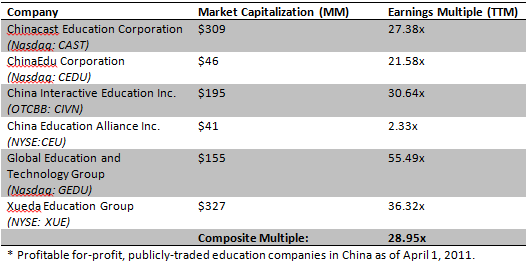

The result is an enormous opportunity for investors, which is evidenced by a composite trailing 12-month earnings multiple of 28.95x for publicly-traded companies operating in the space (see chart below), as well as the hundreds of millions of dollars of foreign direct investment coming into the sector each month from investors around the world.

EastBridge’s Clients Could Hold Significant Valuations

EastBridge Investment Group (OTCBB: EBIG) is well-positioned to capitalize on these trends via its equity stakes in two of its clients: Tsingda Education and Wonder Education. According to a recent interview with TheOTCInvestor.com, the company expects both of these clients to be publicly-traded and perhaps even listed on the AMEX stock exchange by June of 2011.

The value of the company’s equity stakes in these two firms is difficult to assess before they become publicly-traded, but investors can get an idea by looking at the publicly-disclosed net income figures from S-1 filings made with the SEC and then assigning an earnings multiple to those figures, which can be extrapolated using the peer comparison mentioned earlier.

Tsingda Education’s Value

According to Tsingda Education’s S-1 filing with the SEC:

“For fiscal year 2010, we generated $27,447,545 in gross revenues, which represents an 87% increase from gross revenues of $14,650,863 for fiscal year 2009. Our fiscal year 2010 pre-tax net income was $12.1 million, which represents a 70.4% increase from pre-tax net income of $7.1 million for fiscal year 2009.”

In this case, Tsingda Education could trade with a market capitalization of around $350 million, if it trades at an earnings multiple near its peers – or 28.95x, as mentioned above.

Wonder Education’s Value

According to Wonder Education’s S-1 filing with the SEC:

“In the fiscal year ended December 31, 2009, we had a gross profit of $5,946,523 and a net income of $2,597,003.”

Again, upon applying the composite peer multiple of 28.95x, the calculation yields a potential market capitalization of around $75 million.

EastBridge Shareholders Stand to Benefit

EastBridge Investment Group (OTCBB: EBIG) shareholders can benefit from these potentially high valuations in two ways. First, the company’s business model calls for shareholders to receive a 1% to 2% dividend of client shares once they go public on U.S. exchanges. Second, the remaining 8% to 19% stake held by EastBridge itself adds to the company’s own value as both income and an asset.

Given the potential valuation of Tsingda Education and Wonder Education, as well as EastBridge’s current $17 million market capitalization, investors may want to take a closer look at this company.